Opportunity Zone

TAX CUT AND JOBS ACT OF 2017

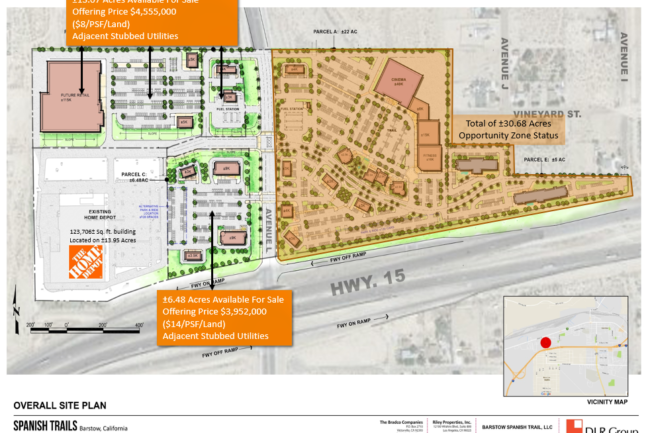

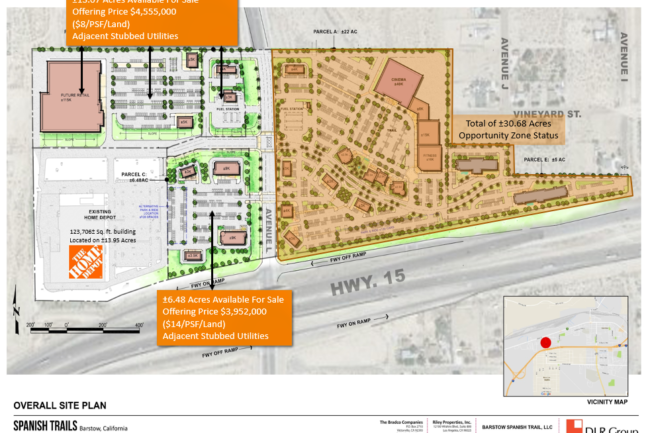

The Shops at Spanish Trail, its initial phase, with nearly 50.0± acres of development land contain 30.68± acres of land within the Opportunity Zones. For more information about this Tax Act, Barstow Spanish Trail, LLC., strongly encourages investors, developers and those that have an economic interest within the project, to contact their accountants and/or attorneys for additional information and verification.

In December of 2017, a federal bill known as the Tax Cuts and Jobs Act of 2017 was passed. The new bill is designed to give investors new incentives to reduce and eliminate capital gain taxes. By doing so, it allows for an incredible tax break for investors through a new program known as Opportunity Zones. Through Opportunity Zones, investors will be allowed to defer their capital gain taxes, as well as a permanently excluding taxable income of capital gains from the sale or exchange of an investment in an Opportunity Fund.

TAX INCENTIVES

The purpose is to have investors reinvest their gains in Opportunity Zone funds. By doing so it will provide tax incentives (to low income areas), as well as temporary tax deferral on investors capital gains. In return, this money is used for qualifying census tract communities, also known as Opportunity Zones. These opportunity zones are designated in the vicinity of residential tracts where there are at least 30 businesses neighboring the sites.

With the Tax Cuts and Jobs Act of 2017, it allows many benefits that Opportunity Zones have for Opportunity Fund Investors that will defer, reduce, and eliminate the recognition of these capital gains through December 2026.

TAX OPPORTUNITY

Accordingly, they permanently avoid taxes on some capital gains when they invest those gains into opportunity funds. Overtime, if taxpayers held these gains in opportunity funds after 5 years, then it would result in 10% of taxes being deferred and results in a 10% increase from the original gain. If the funds are held for 7 years, then it would increase by 5%, resulting in 15% of taxes being deferred.

If the investor were to hold these gains in opportunity funds for more than 10 years, then the taxes will essentially be eliminated on any additional capital gains. This bill allows for the government to pin-point census tract locations that qualify to be Opportunity Zones.

LOCAL ADVANTAGE

There are more than 8,764± communities that are home to nearly 35M± Americans that have been designated for Opportunity Zoned Development.

There are more than 8,764± communities that are home to nearly 35M± Americans that have been designated for Opportunity Zoned Development.

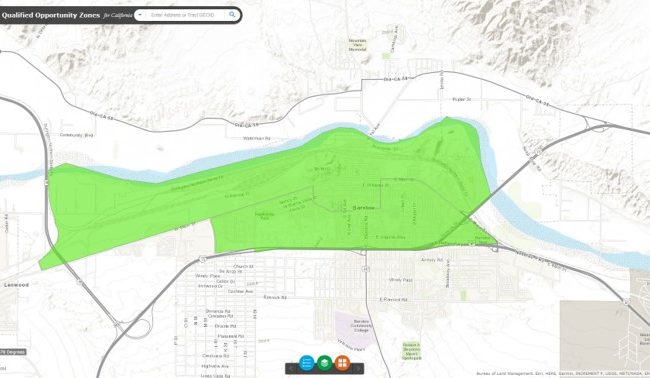

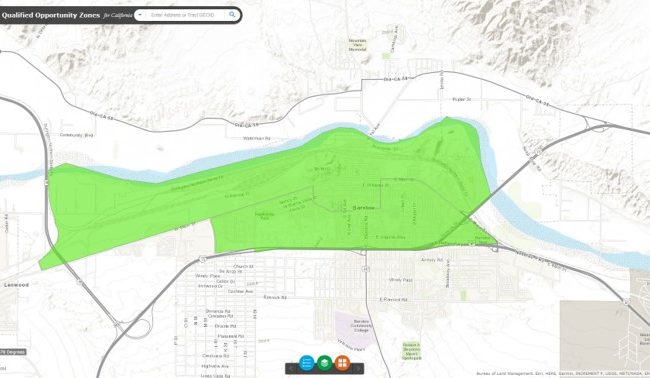

There are 879± Opportunity Zones in California. There are fifty-seven (57) Opportunity Zones in San Bernardino County.

NEW OPPORTUNITY

The first set of regulations issued by the Internal Revenue Service were issued October 19, 2018, which can answer many questions regarding the Opportunity Zone Provisions. The next set which was released on April 17, 2019 clarified a number of those areas.

According to Economic Innovation Group, a major organization that monitors Opportunity Zones, the Opportunity Zone Program is designated to attract investors holding nearly $6.1 Trillion dollars in Capital Gains.

A California non-profit “California Ford” is a golden state opportunity that between $745M and $1.2B in economic activity and Opportunity zones can be created here in California.

Opportunity Zone

TAX CUT AND JOBS ACT OF 2017

The Shops at Spanish Trail, its initial phase, with nearly 50.0± acres of development land contain 30.68± acres of land within the Opportunity Zones. For more information about this Tax Act, Barstow Spanish Trail, LLC., strongly encourages investors, developers and those that have an economic interest within the project, to contact their accountants and/or attorneys for additional information and verification.

In December of 2017, a federal bill known as the Tax Cuts and Jobs Act of 2017 was passed. The new bill is designed to give investors new incentives to reduce and eliminate capital gain taxes. By doing so, it allows for an incredible tax break for investors through a new program known as Opportunity Zones. Through Opportunity Zones, investors will be allowed to defer their capital gain taxes, as well as a permanently excluding taxable income of capital gains from the sale or exchange of an investment in an Opportunity Fund.

TAX INCENTIVES

The purpose is to have investors reinvest their gains in Opportunity Zone funds. By doing so it will provide tax incentives (to low income areas), as well as temporary tax deferral on investors capital gains. In return, this money is used for qualifying census tract communities, also known as Opportunity Zones. These opportunity zones are designated in the vicinity of residential tracts where there are at least 30 businesses neighboring the sites.

With the Tax Cuts and Jobs Act of 2017, it allows many benefits that Opportunity Zones have for Opportunity Fund Investors that will defer, reduce, and eliminate the recognition of these capital gains through December 2026.

TAX OPPORTUNITY

Accordingly, they permanently avoid taxes on some capital gains when they invest those gains into opportunity funds. Overtime, if taxpayers held these gains in opportunity funds after 5 years, then it would result in 10% of taxes being deferred and results in a 10% increase from the original gain. If the funds are held for 7 years, then it would increase by 5%, resulting in 15% of taxes being deferred.

If the investor were to hold these gains in opportunity funds for more than 10 years, then the taxes will essentially be eliminated on any additional capital gains. This bill allows for the government to pin-point census tract locations that qualify to be Opportunity Zones.

LOCAL ADVANTAGE

There are more than 8,764± communities that are home to nearly 35M± Americans that have been designated for Opportunity Zoned Development.

There are 879± Opportunity Zones in California. There are fifty-seven (57) Opportunity Zones in San Bernardino County.

NEW OPPORTUNITY

The first set of regulations issued by the Internal Revenue Service were issued October 19, 2018, which can answer many questions regarding the Opportunity Zone Provisions. The next set which was released on April 17, 2019 clarified a number of those areas.

According to Economic Innovation Group, a major organization that monitors Opportunity Zones, the Opportunity Zone Program is designated to attract investors holding nearly $6.1 Trillion dollars in Capital Gains.

A California non-profit “California Ford” is a golden state opportunity that between $745M and $1.2B in economic activity and Opportunity zones can be created here in California.